UK and US manufacturing slows; eurozone inflation hits 8.6%; petrol at new document – enterprise reside | Enterprise

[ad_1]

UK manufacturing loses extra steam as output development grinds to near-halt

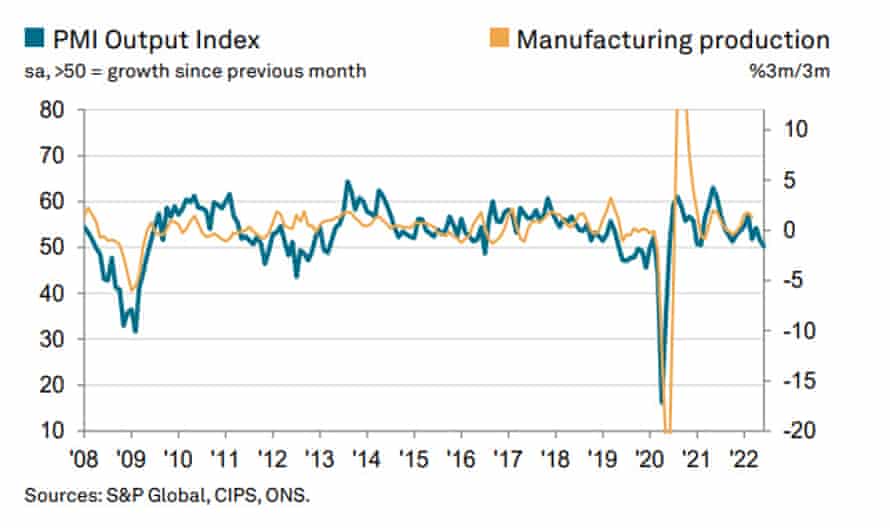

Output development at UK producers floor to a close to standstill in June, the most recent signal that the economic system is slowing as customers in the reduction of.

The closely-watched S&P International / CIPS UK Manufacturing PMI report has additionally discovered that enterprise optimism hit a two-year low final month.

Exercise rose on the slowest tempo in two years, as new orders fell for the primary time since January 2021.

And the buyer items sector was particularly exhausting hit, as family demand suffered a steep retrenchment on the again of the cost-of-living disaster.

🇬🇧 Development within the UK’s manufacturing sector slowed in June with the #PMI at a 2-year low of 52.8 (Might: 54.6). Weaker financial outlook, the conflict in Ukraine and uncooked materials shortages led to a discount in demand. Learn extra: https://t.co/MxsAa9RScr pic.twitter.com/AVAw3zeLTm

— S&P International PMI™ (@SPGlobalPMI) July 1, 2022

The healthcheck on UK factories discovered that:

- Output development slows to near-stagnation tempo…

- …as new order intakes fall for the primary time since January 2021

- Worth inflation stays elevated regardless of additional easing

Corporations blamed the autumn in new enterprise on a spread of issues — together with the weaker financial outlook, decreased new export order intakes, slower development of home demand, the conflict in Ukraine, uncooked materials shortages and the slowdown in China.

New export orders contracted for the fifth month operating in June — with some companies saying ongoing Brexit-related difficulties and weaker development had hit orders from the EU.

This pulled the manufacturing PMI right down to 52.8 from 54.6 in Might. That’s worse than the preliminary “flash” studying of 53.4 taken throughout June, and nearer the 50-point mark exhibiting stagnation.

Rob Dobson, director at S&P International Market Intelligence, stated:

Home market situations turned more and more tough and international demand fell sharply once more, stifled by Brexit, transport disruption, the conflict in Ukraine and a world financial slowdown.

Enterprise confidence took successful consequently, dipping to its gloomiest since mid-2020. Jobs development additionally slowed sharply amid the more and more unsure outlook and up to date surge in power prices.

Dobson warns that financial situations might worsen:

“There have been some welcome indicators that supply-chain constraints and value inflationary pressures might have handed their peaks. Nevertheless, with these constraints nonetheless elevated total and demand headwinds rising, it’s possible that UK manufacturing will see the financial backdrop darken additional within the second half of the 12 months.”

Wall Road has begun the second half of the 12 months because it ended the primary — with share costs dropping.

The benchmark S&P 500 index has shed 18 factors, or 0.4%, in early buying and selling to three,769 factors, including to the 20% plunge because the begin of January.

The Dow is down 0.6% whereas the tech-focused Nasdaq Composite is 0.3% decrease.

There are examples of US shares recovering from first-half tumbles within the second six months of the 12 months, so the markets might flip issues round by December…..

S&P 500 efficiency:

12 months: 1st half: 2nd half: full 12 months:

1962: -23.5% +15.3% -11.8%

1970: -21% +26.7% +0.1%

2022: -20.6%

Supply: S&P Dow Jones Indices

— Jon Erlichman (@JonErlichman) July 1, 2022

…however that would want inflation to ease off, so central bankers might cease tightening coverage fairly so aggressively.

US manufacturing facility development slows to two-year low

Simply in: American producers grew on the slowest tempo in two years final month.

The Institute for Provide Administration’s June Manufacturing PMI fell to 53% final month, down 3.1 share factors from the studying of 56.1% in Might, a stage that exhibits slower development.

US manufacturing facility bosses reported that new orders and employment ranges contracted final month, whereas manufacturing ranges and backlogs continued to rise.

Companies additionally continued to boost costs, however at a slower fee, whle exports and imports grew, and there have been record-long lead instances for capital expenditures and manufacturing supplies

Timothy Fiore, chair of the ISM’s Manufacturing Enterprise Survey Committee, stated US manufacturing continues to be powered — although much less so in June — by demand whereas held again by provide chain constraints.

Sentiment remained optimistic concerning demand, with three constructive development feedback for each cautious remark. Panelists proceed to notice provide chain and pricing points as their greatest considerations.

The Dutch central financial institution chief has apologized for the establishment’s involvement within the Nineteenth-century slave commerce.

It’s the most recent expression of contrition within the Netherlands linked to the nation’s historic position within the commerce in enslaved individuals, Related Press studies.

The apology got here at an occasion on the nationwide day marking the Dutch abolishment of slavery and adopted related strikes in recent times from municipal authorities within the main Dutch cities of Amsterdam, Rotterdam and Utrecht.

De Nederlandsche Financial institution has acknowledged that it was concerned within the transatlantic slave commerce between 1814 and 1863 and even paid compensation to plantation homeowners when the Netherlands abolished slavery, together with to members of the central financial institution’s board on the time.

The financial institution’s president, Klaas Knot, instructed a gathering in Amsterdam:

“As we speak, on behalf of De Nederlandsche Financial institution, I apologize for these reprehensible details.”

I apologize to all those that, due to the private selections of many, together with my predecessors, have been decreased to the colour of their pores and skin.”

Two years in the past the Financial institution of England apologised for the involvement of a few of its previous governors and administrators within the slave commerce, and pledged to take away all statues and work of them from public show at its London headquarters.

Provide chain disruptions delay supply of 95,000 GM automobiles

Common Motors has revealed that round 95,000 partly-built automobiles are sitting in its stock ready for elements, attributable to provide chain disruption and shortages of semiconductors.

GM will maintain these 95,000 automobiles “manufactured with out sure elements” till they’re accomplished, and expects to promote them to sellers all through the second half of 2022.

Steve Carlisle, GM govt vp and president for North America says:

We admire the endurance and loyalty of our sellers and clients as we attempt to fulfill important pent-up demand for our merchandise, and we’ll work with our suppliers and manufacturing and logistics groups to ship all of the models held at our vegetation as shortly as doable.

GM says this shouldn’t have an effect on its full-year earnings steering, however internet earnings for the final quarter will likely be beneath consensus:

For the three months ended June 30, 2022, we anticipate internet earnings to be within the vary of between $1.6bn and $1.9bn and EBIT-adjusted to be within the vary of between $2.3bn and $2.6bn.

$2.4bn was the consensus

*GENERAL MOTORS SEES 2Q NET INCOME $1.6B TO $1.9B

— George Pearkes (@pearkes) July 1, 2022

GM additionally reported that US gross sales within the second quarter fell 15% year-on-year, nevertheless it nonetheless grew market share.

Grocery store gas retailers have stopped chopping pump costs to encourage clients into their shops, motorists have been warned, after petrol hit a brand new excessive yesterday (see earlier put up).

RAC gas spokesman Simon Williams stated the rise within the worth of petrol to 191.4p illustrates “the most important retailers’ resistance to scale back their pump costs in keeping with the decrease wholesale price of unleaded”.

“Slightly than passing on a few of the financial savings they’re benefiting from, they’re clearly banking on the wholesale market shifting up once more which is disappointing for drivers who’re determined to see an finish to ever-rising costs.

“Sadly, there not appears to be any urge for food among the many large 4 supermarkets to drive clients into their shops with decrease pump costs.

“We query whether or not we’ll ever see a lot competitors between supermarkets over gas once more, not to mention a so-called ‘worth conflict’.”

The deliberate sale of the Kohl’s division retailer chain is off, as unstable markets sink one other deal.

Kohl’s entered unique talks early this month with Franchise Group, the proprietor of Vitamin Store and different stores, on a deal price about $8bn.

However with inventory costs nonetheless underneath strain, inflation rising, and client confidence weak, negotiations are off.

“Given the setting and market volatility, the Board decided that it merely was not prudent to proceed pursuing a deal,” stated Kohl’s Chairman Pete Boneparth.

Regardless of a concerted effort on either side, the present financing and retail setting created important obstacles to reaching an appropriate and totally executable settlement.”

People have grown extra cautious with their spending with repeated financial alerts that recommend the economic system is slowing.

Shares of Kohl’s, based mostly in Wisconsin, have fallen over 18% in premarket buying and selling.

Earlier this week Walgreens Boots Alliance deserted a sale of Britain’s greatest chemist, Boots, blaming world monetary market situations which meant potential consumers have been struggling to fund an appropriate supply.

UK customers borrow extra, save much less, amid squeeze

Financially squeezed households deposited much less cash into accounts in Might than in April, the most recent Financial institution of England information exhibits.

Round £5.7bn was saved in banks, constructing societies and NS&I accounts in Might, down from a internet movement of £6.3bn in April.

With inflation at 40-year highs, and meals and power payments hovering, households have been left with much less spare money to save lots of (in contrast to throughout lockdowns, when pressured saving jumped)

Customers additionally borrowed a further £800m in client credit score final month, together with £400m extra on bank cards.

That’s beneath the pre-pandemic stage, and likewise lower than economists anticipated. Shopper credit score typically rises throughout good financial instances, as individuals are assured they will borrow extra.

But it surely may also be an indication that households are struggling, needing to place important purchases on credit score.

Poland’s manufacturing sector suffered a pointy fall in output final month.

Excessive inflation and ongoing geopolitical turbulence led to a noticeable drop off in new orders, resulting in a pointy contraction in manufacturing.

Jobs have been reduce, while enterprise confidence sank to its lowest stage because the peak of the primary Covid-19 pandemic wave in 2020, the most recent survey of buying managers exhibits.

Poland’s manufacturing PMI dropped to 44.4 in June, a stage solely beforehand seen through the world monetary disaster and the pandemic… (1/4) pic.twitter.com/StDVMeG7dz

— S&P International PMI™ (@SPGlobalPMI) July 1, 2022

…producers are reporting that the conflict in Ukraine and excessive inflation is eroding buying energy, however the lack of momentum in June was startling…(2/4) pic.twitter.com/UN1u2OWxZf

— S&P International PMI™ (@SPGlobalPMI) July 1, 2022

…though, regardless of remaining elevated, there are indicators that supply-chain inflation is dissipating…(3/4)

— S&P International PMI™ (@SPGlobalPMI) July 1, 2022

July hasn’t introduced a lot cheer to the markets, with manufacturing facility development slowing, and inflation hovering.

After a uneven morning, the FTSE 100 index is down 0.3% or 20 factors at 7,148 factors.

The pan-European Stoxx 600 has misplaced 0.5%, after Asia-Pacific markets have been pulled down by disappointing manufacturing facility development information.

A market indicator measuring how buyers are positioned held at “extraordinarily bearish” ranges for a 3rd consecutive week, as buyers pulled extra cash out of equities and bonds, BoFA Securities stated in a weekly be aware

Outflows from European fairness funds prolonged into its twentieth week, whereas rising market debt has now seen outflows for the previous 12 weeks, BoFA stated citing EPFR information.

In an indication that inflationary expectations haven’t but peaked, inflows into inflation-adjusted bond funds noticed their greatest inflows in 12 weeks.